Super League Gaming, Inc.

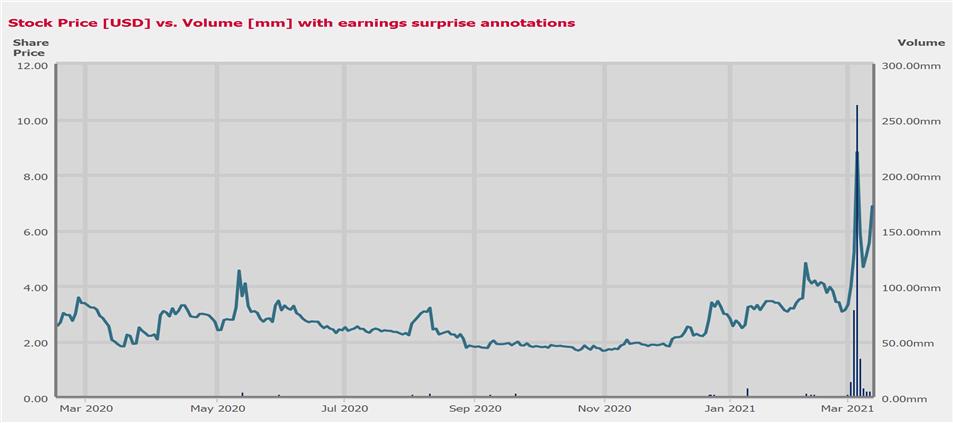

NasdaqCM:SLGG

FQ4 2020 Earnings Call Transcripts

Thursday, March 11, 2021 10:00 PM GMT

S&P Global Market Intelligence Estimates

|

|

-FQ4 2020-

|

-FQ1 2021-

|

-FY 2020-

|

-FY 2021-

|

|

|

CONSENSUS

|

ACTUAL

|

SURPRISE

|

CONSENSUS

|

CONSENSUS

|

ACTUAL

|

SURPRISE

|

CONSENSUS

|

|

EPS (GAAP)

|

(0.27)

|

(0.31)

|

NM

|

(0.20)

|

(1.57)

|

(1.64)

|

NM

|

(0.77)

|

|

Revenue (mm)

|

0.80

|

0.78

|

(2.50

%) (2.50

%)

|

0.92

|

2.09

|

2.06

|

(1.44

%) (1.44

%)

|

5.05

|

Currency: USD

Consensus as of Mar-01-2021 12:20 PM GMT

|

|

- EPS (GAAP) -

|

|

|

|

CONSENSUS

|

ACTUAL

|

SURPRISE

|

|

FQ1 2020

|

(0.52)

|

(0.60)

|

NM

|

|

FQ2 2020

|

(0.48)

|

(0.48)

|

NM

|

|

FQ3 2020

|

(0.40)

|

(0.36)

|

NM

|

|

FQ4 2020

|

(0.27)

|

(0.31)

|

NM

|

|

Call

Participants

|

|

3

|

|

Presentation

|

|

4

|

|

Question

and Answer

|

|

12

|

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

|

|

|

Call Participants

|

|

EXECUTIVES

Ann Hand

CEO, President & Chair of the Board

Clayton J. Haynes

Chief Financial Officer

ANALYSTS

Allen Robert Klee

Maxim Group LLC, Research Division

Brian David Kinstlinger

Alliance Global Partners, Research Division

William Morrison

|

|

|

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Presentation

Operator

Good afternoon, everyone, and thank you for participating in

today's conference call to discuss Super League Gaming's financial

results for the fourth quarter ended December 31, 2020. Joining us

today are Super League's President and CEO, Ann Hand; and CFO,

Clayton Haynes.

Following their remarks, we will open the call for your questions.

Before we go further, please take note of the company's safe harbor

statement within the meaning of the Private Securities Litigation

Reform Act of 1995. The statements provides important cautions

regarding forward-looking statements. The company's remarks during

today's conference call will include forward-looking statements.

The statements, along with other information presented that does

not reflect historical fact, are subject to a number of risks and

uncertainties. That's all filed with the Securities and Exchange

Commission for more information about the risks and uncertainties

that could cause actual results to differ.

I would now like to remind everyone that this call is being

recorded and will be available for replay to March 18, 2021,

starting at 8:00 p.m. Eastern Time tonight. Our webcast replay will

also be available via link provided in today's press release as

well as on the company's website at www.superleague.com. Now I

would now like to turn the call over to Mr. -- President and CEO of

Super League Gaming, Ann Hand. Go ahead, please.

Ann Hand

CEO, President & Chair of the Board

Good afternoon, and thank you for joining us on this momentous day

for our company. I can't begin to tell you the palpable enthusiasm

and confidence flowing from our all staff Zoom this morning when we

shared our latest news of the proposed acquisition of Mobcrush, a

wildly stark contrast to 1 year ago, when we completed our fourth

quarter 2019 earnings call and saw the world go into

lockdown.

But that challenge that upended the world transformed Super League

for the better. We saw a surge in engagement that has not only

held, but continuously grown in very material ways, giving us heft

and critical mass. It forced us to focus, to double down on what

was working. And it certainly offered us a window to explore

inorganic growth in addition to our explosive organic

growth.

Before I get into today's announcement and what it means for us, I

want a table set a bit on the wider industry, the trends and our

positioning. Our focus has always been to provide competitive video

gaming and e-sports entertainment for everyday players of all ages.

And over the last year, we have leaned more and more into putting

these tools into the hands of the players themselves, to create and

share their own gameplay and relevant content with

others.

This mission speaks to the overall democratization of content

creation, the Gen Z and millennial thirst to create and share and

their desire to spend more and more of their day connecting and

communicating in a virtual space and time and in a highly engaging

and creative way. And gaming is only an entry point. It's bigger

than that.

Super League is a social media and entertainment platform.

Yesterday's Roblox direct listing on the New York Stock Exchange

further validated this. Their metaverse has similar themes to ours.

I say that humbly, of course. We engage with large audiences of

gamers and extend beyond just gameplay. And there are 3 sources of

value from this. First, the way we create a powerful marketing

channel for advertisers to reach this elusive coveted audience;

second, direct gamer creator monetization, A.K.A.

direct-to-consumer through a shared virtual economy.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Our digital marketplace launch that we seeded in the second half of

2020 does just that. And empowers the players and creators

themselves to create a diverse breadth of digital goods that speak

to precisely what our community wants and allows them to

participate in the economy. And the third lane of value, the

massive amount of derivative content produced on platform that in

itself can become a source of revenue.

So now that I have shared some key macro trends that speak to how

Gen Z and millennials want to create, share and participate in

their own content creation, and how that has established a powerful

business model for both the mighty Roblox and, of course, for Super

League, it is a perfect segue to what we believe to be the most

material shift in Super League's overall trajectory, providing a

step function increase in not just our scale, but also our forward

revenues.

Again, today, we announced our intention to acquire Mobcrush.

Mobcrush is a company we have known and admired over the last few

years with great leadership and technology. They are a live

streaming platform used by hundreds of thousands of gaming

influencers who generate and distribute almost 2 million hours of

original content annually to their own social audiences,

aggregating more than 4.5 billion fans and subscribers across the

most popular live streaming and social media platforms, including

Twitch, YouTube, Facebook, Instagram, Twitter and

more.

Mobcrush also owns Mineville, 1 of the 6 exclusive official

Minecraft server partners enjoyed by more than 22 million unique

players annually. So let's break this down a bit more as the 2

companies line up beautifully in all of the most important ways.

First, let's talk about our customers and our offers. Super League

has consistently focused on what we call the middle of the pyramid.

There are 3 billion gaming enthusiasts in the world, with our

target being what we describe as the mid-tier gamer.

So they are highly competitive. They are likely sharing their

gameplay and entertainment content more widely. They are highly

engaged. Our offers, such as Framerate, Super League Arena and

Super League TV, align with that segment. And uniquely, inside of

that tier, we have a growing foothold on the younger engaged gamer,

mainly through our owned and operated digital property Minehut, one

of the world's largest expanding online communities of Minecraft

players with over 1 million monthly uniques.

Players enjoy freemium private server hosting, along with social,

gameplay and entertainment experiences. And Mobcrush focuses on the

same segments. Mobcrush's free live streaming toolkit is offered to

up and coming mid-tier streamers, that middle of the pyramid again,

as a way to build and monetize their own live stream

content.

The company's mission is to enable streamers an opportunity to turn

their passion into their livelihood. This demographic aligns with

Super League's 16- to 34-year-old demographic. As well their

Mineville product is highly complementary to our Minehut audience,

squarely focused on young, avid Minecraft players.

And it is exciting to think about how these segments intersect. The

combined company has amassed a suite of offers that mirror the

gamer journey. The young gamer and creator today is tomorrow's

streamer, tomorrow's influencer, maybe even tomorrow's e-sports

star. So now let's dive into monetization. And again, I think

you'll see there is great alignment.

First, both firms have focused on audience development to create

real heft, material reach to support their primary revenue stream

to date, a premium advertising model. Media is all about scale. And

while both firms have reached a degree of critical mass organically

and individually, the combination makes us a leading provider of

content-driven advertising solutions, in event, in stream, and in

game, providing brands, advertisers and other consumer-facing

businesses with massive audience reach across the most important

engagement channels in video gaming, competitive events, social

media and live streaming content, along with in-game

experiences.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

With this acquisition, we are building a formidable, highly

scalable gaming-centric media and advertising platform that reaches

one of the largest addressable audiences of gamers in the United

States. Super League's premium owned and operated in game and video

inventory, coupled with Mobcrush's television equivalent and ad

blocker proof in-stream sponsor inventory creates a sought-after

solution for advertisers targeting gamers.

Let's face it. We all know kids who game. And when they are playing

or watching their favorite streamer, the room could be on fire, and

they wouldn't notice it. We can place brands in front of those

players and viewers right then, right there. Next, we both share a

growing second pillar of revenue, direct gamer monetization through

our Minehut and Mineville properties. I mentioned earlier Minehut's

early stage marketplace, offering players and creators both

subscription and onetime digital offerings that allow our customers

to expand their server capability, buy cosmetic goods, and in the

future, purchase access to new games.

Similarly, in Mineville, players can purchase digital goods in

Minecraft's marketplace, such as game entry fees and cosmetic

skins. There is so much opportunity to significantly amplify both

of these businesses through the cross-marketing of our communities

and the cross-fertilization of our offers.

And there is a third emerging leg of revenue, one that we have

talked about on previous calls as somewhat pandemic powered for

Super League around both the value of our content and our

proprietary technology to create and distribute

content.

We already have proof points. Last year, we generated over $400,000

of revenue, syndicating our derivative content to others like

Snapchat and Cox media. And we now have partnerships in place or

pending to syndicate our content through 3 OTT

services.

As well, we have several media companies in the mix, sampling our

patented visualization and cloud-based remote video production and

broadcast technology, Virtualis Studios for their own production

needs. The headline, "the tools we create for ourselves, for our

own experiences have value to top-tier broadcasters." Similarly,

again, Mobcrush's live streaming technology platform, and

proprietary AI-driven gameplay highlights software amasses a large

amount of derivative content that when coupled with ours, creates a

compelling library of competitive gameplay and entertainment

content.

And there's even more upside. Imagine if we combine our live

streaming technology stack. Together, the companies can provide

content producers at all levels: Streamers, creators, digital and

television production companies, branded content studios and more

with an exciting suite of tools and capabilities designed both for

the unique needs of today's production and distribution realities

and the enduring changes resulting from the pandemic.

So collectively, who do we target? Everyday competitive gamers,

creators and streamers. Well, we can check the box on that. What do

we offer in a combined sense? Technology that supports the creation

of competitive gameplay and live stream entertainment content,

checked again.

How do we monetize? Through our premium advertising model, our

direct-to-consumer offering and our gaming and live stream content

engine and library. Check again.

Before I hand it over to Clayton, I want to quickly touch on the

compelling metrics as well. Again, I can't say enough about how

joining forces takes us to a whole new level of scale. The combined

companies reach more than 25 million players per year, 3 million

players per month and with over 400,000 players per day. As well,

we reach a U.S. viewing audience of 85 million monthly, making for

a top 50 U.S. media property as verified by Nielsen.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Annually, we have over 7.7 billion U.S. video views across live

streaming platforms, 2 billion views on social media platforms and

enable 60 million hours of gameplay on owned and operated

platforms. And another point of unique synergy. Collectively, we

generate and distribute over 200,000 gameplay highlights across

streaming and social channels per month. Brands and advertisers

will take notice of this expand scale and scope.

Now I know you all want me to speak to financials. As we know, the

priority #1 is to smartly continue to drive our top line. While we

want to focus on getting the deal closed and are in the midst of

completing the financial audit, I can share that Mobcrush's

unaudited revenues for 2020 were over $6 million.

Similar to Super League, Mobcrush responded to the pandemic with a

strong recovery. Audited financials will be filed with the SEC when

required and available, but this is less about looking back and

more about looking forward. The combined companies have a very

bright 2021 and beyond. At this point, I will turn the call over to

our CFO, Clayton Haynes, who will provide an overview of fourth

quarter financial results, after which I will come back with some

closing remarks. Clayton?

Clayton J. Haynes

Chief Financial Officer

Thank you, Ann, and good afternoon, everyone, and thank you for

joining us for today's fourth quarter and year-end 2020 earnings

conference call. First, I would like to summarize our fiscal 2020

KPI results. Then I will move on to a summary of our Q4 and our

full year 2020 financial results and wrap up with a brief summary

of some of the details of the proposed M&A transaction we

announced today.

As you know, each quarter, we provide updates on our key

nonfinancial performance indicators that we believe help investors

understand and gauge the progress we are making with respect to

building our business and the long-term opportunity we see in front

of us. We will continue to provide KPIs, but over time, we may

focus on different metrics as our business evolves.

Currently, we continue to focus and report on 3 primary

nonfinancial KPIs, the first being registered users; the second

being video views; and the third being hours of engagement. Looking

at our KPI metrics as of the end of 2020, we saw dramatic increases

in our audience size and level of engagement over the course of the

2020 fiscal year.

We ended 2020 with nearly 3 million registered users, roughly 3x

the number at the end of 2019 and easily surpassing our goal of 2

million registered users for 2020. In 2020, we experienced over 2

billion video views, which is nearly 20x the number in 2019 and

several times the level of video views we had targeted at the

beginning of the year.

And lastly, we saw over 72 million hours of engagement, mostly

gameplay across all of our platforms, nearly 5x the total we saw in

2019. We posted a strong year of KPI performance in 2020, and we

look forward to continuing the trend of strong KPI performance in

2021, which we believe will continue to underpin and drive revenue

growth.

Moving on to the fourth quarter of 2020 financial results. Overall,

from a financial statement standpoint, fourth quarter 2020

highlights included an approximately 3x increase in revenues,

reflecting strong growth in our advertising and content sales

revenues relative to the comparable prior year quarter, with Q4

2020 establishing another record quarter of revenues for Super

League eclipsing the record quarterly revenues previously

established in Q3 2020.

In addition, we continued our strong trend of strong margins,

reporting average margins of 62% in Q4 2020 compared to 50% in the

comparable prior year quarter as we continued leaning into our

largely digital and online offers and revenue-generating

activities.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

From an operating expense standpoint, we saw increases in sales and

marketing expenses related to the build-out of our direct sales

team earlier in 2020 and an increase in technology platform

infrastructure costs, due to the surge in engagement across our

digital properties in 2020.

Taking a look then in more detail at our fourth quarter 2020

results as summarized in our earnings release filed today. Fourth

quarter 2020 revenues increased 197% to $779,000 compared to

$262,000 in the comparable prior year quarter. Advertising and

content-related revenues, which includes brand sponsorship and

customized brand partner program revenues, traditional advertising

revenues and third-party content licensing revenues, comprised

approximately 92% of revenues for the fourth quarter of 2020 as

compared to 97% of revenues for the comparable prior year

quarter.

The increase in quarterly revenues was primarily driven by an

increase in advertising revenues across our branded digital

channels, reflecting, in part, the impact of the build-out of our

direct sales force earlier in 2020, the significant growth in our

advertising inventory and surge in engagement during 2020, and an

increase in third-party content sales revenues in connection with

the duration, repackaging and sale of our owned and user-generated

content highlighted by our content sales activities with Snap

Inc.

Direct-to-consumer revenues in the fourth quarter of 2020, which

were primarily comprised of digital goods revenues related to our

Minehut digital property, accounted for 8% of revenues for the

fourth quarter of 2020 and increased approximately 7x compared to

the prior year quarter, continuing our trend of and reflecting our

focus on accelerating the increase in direct-to-consumer

monetization.

We continue to focus on ramping up overall direct-to-consumer

revenues, including sales of digital goods and the continued

rollout of our micro transaction marketplaces, as Ann mentioned

earlier. During the fourth quarter of 2020, we continued our strong

trend of working with repeat customers, including our partnerships

with Topgolf, Gen.G, Logitech and Cox Media as well as working with

new partners, including the Indiana Esports Development Group,

Moose Toys and Bosch.

For the fourth quarter of 2020, 2 customers accounted for 36% of

revenues, as compared to 3 customers accounting for 72% of revenues

in the prior year quarter. As with all advertising-based business

models, COVID-19 had an impact on the timing and distribution of

advertising revenue during 2020, but we feel we recovered and are

continuing to recover well.

We have made substantial progress in building our direct sales team

and in building our views and impressions during 2020 and expect

our advertising inventory to continue to grow going forward so that

as advertisers and brands continue to rebound, we are ready to

continue taking advantage of the monetization

opportunities.

As a percent of revenue, gross profit in the fourth quarter of 2020

was 62% compared to 49% in the prior year quarter. Fourth quarter

2020 cost of revenue increased 121% to $296,000 compared to

$134,000 in the comparable prior year quarter, representing a 39%

lower percentage increase in cost of revenue than the 197% increase

in revenues for the same period.

The significantly lower increase in cost of revenue on a relative

basis was driven by the increase in lower cost advertising and

content sales revenues and our largely digital and online

revenue-generating activities in the fourth quarter of 2020. Cost

of revenues continue to fluctuate period-to-period based on the

specific programs and revenue streams contributing to revenues each

period, and the related cost profile of our advertising and content

sales activities and our digital online and/or physical in-person

experiences occurring each period.

Fourth quarter 2020 GAAP operating expenses were $5.2 million, 8%

higher than the comparable prior year quarter. Noncash stock

compensation expenses in the fourth quarter of 2020 decreased 54%

to $434,000 as compared to $951,000 in the fourth quarter of 2019.

The decrease was offset by an increase in sales and marketing and

personnel costs related to the build-out and investment in our

direct sales force in early 2020 as we continued to invest in the

monetization of our growing ad inventory, an increase in technology

platform infrastructure costs, primarily related to our cloud

services, consistent with the surge in engagement we experienced

during 2020.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

And lastly, the impact of higher public company insurance costs

relative to the prior year. On a GAAP basis, which includes the

impact of noncash stock compensation charges, net loss for the

fourth quarter of 2020 was $4.7 million or $0.31 per share compared

to a net loss of $4.7 million or $0.55 per share in the comparable

prior year quarter. Excluding noncash stock compensation charges,

our pro forma net loss for the fourth quarter of 2020 was $4.3

million or $0.28 per share compared to $3.7 million or $0.44 per

share in the comparable prior year quarter.

The weighted average number of shares outstanding for both GAAP and

non-GAAP earnings per share was approximately 15.5 million shares

in the fourth quarter of 2020 compared to approximately 8.6 million

shares in the prior year quarter. As a reminder, and as described

in our earnings release today, pro forma net income or loss is a

non-GAAP measure that we believe investors can use to compare and

evaluate our financial results along with other applicable KPIs and

metrics discussed earlier.

Please note that our earnings release contains a more detailed

description of our calculation of pro forma net loss as well as a

reconciliation of pro forma net loss with the most directly

comparable financial measures prepared in accordance with U.S.

GAAP.

Next, let me briefly review our full year 2020 results. In summary,

in fiscal year 2020, we saw a 90% increase in revenues recognized

across our 3 primary revenue streams with a continuing trend of

strong and improving margins stemming from efficiencies and lower

cost revenue-generating activities.

Operating expenses increased year-over-year, reflecting our

investment in our direct sales function, and increases in

technology and infrastructure costs in connection with the

remarkable surge in engagement across our digital properties during

2020.

These increases were partially offset by a decrease in primarily

performance-based noncash stock compensation charges and facilities

costs. Moving into the details. For fiscal 2020, revenues totaled

$2.1 million, an increase of 90% from the $1.1 million in total

revenues we reported in 2019. This increase was primarily driven by

an 81% increase in sponsorship and advertising revenue including

third-party content sales revenues and an increase of over 300% in

direct-to-consumer revenues in 2020.

In fiscal 2020, 4 customers accounted for 49% of revenues compared

to 5 customers accounting for 69% of revenues in fiscal 2019. As a

percent of revenue, fiscal year 2020 gross profit was 59% compared

to 53% in 2019. Cost of revenue for fiscal 2020 was $856,000, up

67% from $513,000 in 2019, reflecting a 26% lower percentage

increase in cost of revenues compared to the 90% increase in

revenues for the same 12-month period.

The significantly lower increase in cost of revenue on a relative

basis was driven by the increase on lower cost advertising and

third-party content sales revenues and our largely digital and

online revenue-generating activities in fiscal year 2020, compared

to fiscal year 2019.

On a GAAP basis, total operating expenses were $20 million, down

slightly from $21.3 million in 2019. For fiscal year 2020, GAAP

operating expenses included $2 million in noncash stock

compensation expense, down from $6.2 million in 2019. Excluding

noncash stock compensation expense, total operating expenses for

2020 were $17.9 million, up 19% from $15.1 million in

2019.

The increase was primarily due to an increase of 18% in selling,

marketing and advertising expenses in connection with the

investment in our direct sales force; a 34% increase in technology

and platform development costs due primarily to the surge in

engagement across our digital properties in 2020; and a 9% increase

in general and administrative costs due to an increase in corporate

insurance and a full year of other public company-related

costs.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Our net loss on a GAAP basis in 2020 was $18.7 million or $1.64 per

weighted average diluted share compared to $30.7 million or $3.89

per weighted average diluted share in 2019. Pro forma net loss,

which excludes noncash stock compensation as well as 2019 noncash

interest costs was $16.3 million in 2020 compared to $14.5 million

in 2019.

The weighted average diluted share count for the full year 2020 was

11.4 million compared to 7.9 million in 2019. From a balance sheet

perspective, as of December 31, 2020, we had $7.9 million in cash,

approximately $7.5 million in working capital and total

shareholders' equity of $10.9 million. Our current monthly net cash

burn rate continues to be, on average, approximately $1.3 million

per month. We continue to be focused on reductions of our cost

structure, particularly in the area of technology platform

infrastructure costs and other areas as identified.

As previously reported, in June 2020, we vacated approximately 75%

of our office space in Santa Monica, resulting in significant rent

and facilities cost savings going forward, and we continue to work

with existing and new platform infrastructure service providers to

reduce those costs going forward as well.

Subsequent to year-end, as previously reported, in January and

February 2021, we strengthened our balance sheet, closing

registered direct offerings of an aggregate of 3.1 million and 2.9

million shares of our common stock, raising gross proceeds of

approximately $8 million and $12 million, respectively. We

currently intend to use the net proceeds from the offerings for

working capital and general corporate purposes, including sales and

marketing activities, product development and capital expenditures

as we continue to grow the business and focus on the continued

acceleration of monetization.

In summary, in Q4 and fiscal year 2020, we saw the highest revenue

quarter and highest annual revenues reported in the company's

history, driven by significant increases in our advertising,

third-party content sales and direct-to-consumer revenues relative

to prior year periods, underpinned by the enhancement of our direct

sales force, growth in advertising inventory and the flexibility of

our technology platform as it relates to broadcast and proprietary

end user-generated content.

Fiscal 2020 also saw a favorable average margin trends reflecting

our largely online and digital activities in the quarterly and full

year periods, while identifying areas for cost reductions in future

periods all while balancing our focus on the acceleration of

monetization of our rapidly growing advertising inventory and

investment in our growth initiatives in response to the overall

surge in engagement during the period.

Lastly, a few comments on our transformative M&A-related

announcement today. Ann has already addressed the strategic

benefits of the proposed acquisition of Mobcrush, but I will

provide some additional detail with respect to the acquisition

agreement.

From a structure standpoint, Super League entered into an agreement

in plan of merger, by and among Mobcrush Streaming, Inc., Super

League and Super League Merger Sub. The merger agreement provides

for the acquisition of Mobcrush by Super League pursuant to a

reverse triangular merger structure with Mobcrush as the surviving

corporation in an all common stock deal.

Upon completion of the merger, Mobcrush will be a wholly owned

subsidiary of Super League. In accordance with the terms and

subject to the conditions of the merger agreement, each outstanding

share of Mobcrush common stock and preferred stock will be canceled

and converted into the right to receive 0.528 shares of Super

League common stock as determined in the merger agreement. Subject

to certain adjustments and other terms and conditions more

specifically set forth in the merger agreement, SLG will be issuing

approximately 12.6 million shares of SLG common stock at the merger

consideration.

The proposed merger is subject to certain customary closing

conditions, including being subject to obtaining approval from a

majority of Super League shareholders at a special meeting that we

expect to be held before the end of April 2021. Please refer to our

current report on Form 8-K regarding the proposed merger that we

filed with the SEC earlier today for additional information. Thank

you again for joining us today. With that, I will turn the call

back over to Ann for some additional remarks. Ann?

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Ann Hand

CEO, President & Chair of the Board

Thank you, Clayton. Before we turn to questions, let me offer a bit

more context on the key drivers that we have spoken about on

previous calls that indicate the underlying health of our business

model across our 3 revenue streams. Some highlights from our

advertising model.

The revenue traction continues. We have talked about the health of

the pipeline, the importance of winning a larger share of

advertiser's wallet and the value of swifter closings and repeat

deals. So far in 2021, the average size of our won deals is 2x that

of 2020, and over 50% is repeat business.

And 6-figure deals represent over 35% of the deal opportunities we

are pursuing, maintaining all the while our premium CPM in the $15

to $20 range. For Super League's direct-to-consumer business, while

early, we have some strong indicators as well. Through February, we

have grown to 3.4 million registered users, and as mentioned, 1

million monthly unique users.

And in that same month, the average user spent approximately 11.5

hours on our platform. We like the trends on player monetization as

well. Our average purchase size is holding up at $10 to $12, albeit

we still have a small percentage of players who have become buyers

with our freemium model. But we're improving it and optimizing

it.

A proof point. Our very smart, nimble and light marketing

investment accounts for over 30% of our new user registrations in

the month of February at a mere customer acquisition cost, or CAC,

of less than $0.20 per new user. And on the content front, our

swift pivot to more quickly monetize our content library and our

proprietary content technology became a meaningful tranche of

revenue in 2020 with a good outlook ahead.

We delivered 290 episodes of original content across Snapchat and

Instagram, 5x the amount of content we produced in all of 2019. And

through February, we continued the momentum, having produced 54 new

episodes.

I mentioned the revenue we generated off of those content

syndication deals, but the margin profile is strong as well. The

average episode sees margins in the 75% range. How do we achieve

that? Well it comes back to the power of Virtualis Studios. Our

content is formatted for easy syndication using our highly flexible

and affordable technology platform.

On our last earnings conference call, I laid out some of the

strategic goals for the coming months. Number one, to continue to

grow our audience and engagement; number two, to increase our

monetizable advertising inventory; number three, to further

optimize our revenue per user and customer acquisition costs on the

direct-to-consumer front; number four, to expand our servable

market through newer offers; and number five, to make progress on

inorganic growth, either through strategics or M&A

activity.

I hope you agree that through our intended acquisition of Mobcrush,

we've now taken the business up several notches. The combined

company will continue to build on our compelling value proposition:

A gameplay and entertainment platform, a gamer-centric media and

advertising solution and a player creator virtual

economy.

I have often said that one of our most unique distinctions is that

while we are small in size and early in our revenue story, we punch

above our weight with partners, advertisers and the gamers

themselves. Well, in our view, we are about to jump a weight class

or 2. And now we would be delighted to take your questions.

Operator?

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Question and Answer

Operator

[Operator Instructions] And for your first question comes from the

line of Brian Kinstlinger with Alliance Global

Partners.

Brian David Kinstlinger

Alliance Global Partners, Research Division

Great. I assume Mobcrush generates all its revenue through

advertising. And if so, how much is programmatic versus direct

sales? And then maybe you can talk about the impact on the cash

burn as you burned $16 million in each of the last 2 years. Does

Mobcrush improve that burn by itself? Or does it increase that

burn?

Ann Hand

CEO, President & Chair of the Board

Yes. I mean, certainly, with all M&A activity, you're always

looking for both the top line amplification as well as the

potential synergies that can be borne out of the cost and the

infrastructure. We do have very highly complementary businesses, as

I already laid out. And while we do believe there will be

additional cost synergies by bringing those companies together, I

think the part that we think is the biggest grab we'll be able to

take on the cost side, Brian, is going to be the infrastructure

cost.

Because when you think about us both being entirely cloud-based

companies and having the kind of surge of engagement that we're

having, that is one of the biggest line items on our cost

structure. So we're super excited to see what kind of synergies we

can gain from that.

Obviously, we're in the midst of an audit. So we can't get into

specifics about that. It was important for me to be able to show

you a little bit about the shape of the top line, but we really

just need to walk through the next week or 2, get the audit

complete and then we'll be able to file that information and have

that full transparency with all of you.

As far as the top line goes, it's correct. It's fair to say that

it's primarily ad revenue, much like ours. But I have to tell you,

the Mineville business is a valuable business in itself. It's

highly complementary, as I said, to our Minehut

business.

And again, I'd like the audit to make its way through, but it does

represent a decent enough amount of that $6 million unaudited

revenue number that I mentioned to make it a material leg of

revenue going forward. So advertising is still #1 for both of us,

but we see really nice traction and growth on the

direct-to-consumer side.

Brian David Kinstlinger

Alliance Global Partners, Research Division

And there's -- just to be clear, theirs is direct sales not

programmatic?

Ann Hand

CEO, President & Chair of the Board

So yes. So thank you for clarifying. Yes, so they do have a direct

sales arm, as do we, which is the primary reason and way that we

get that kind of high CPM because we offer that high deep

engagement. That said, when you look at their video inventory and

increasingly ours, we have been testing some programmatic video

models and we are seeing kind of $10, $12 CPMs off

that.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

So when our direct sales is not selling out that video inventory,

we're able to supplement it with programmatic. We think we can

apply that same opportunity to some of the video inventory inside

of Mobcrush's ad inventory as well.

What we want to do, the key is -- on programmatic is while there's

some minimal amounts of testing we're doing on display

programmatic, we all know that, that kind of ruins customer

experience, and it's a low CPM model. What we want is we want more

and more video units. And if we can fill in some of that

programmatically and smartly so we don't have to add a direct sales

force person every time we expand ad inventory. As long as it's

good content, we're up for that.

So yes, I would say, right now, the companies are primarily driven

off direct sales, but we're excited about where video programmatic

could go.

Brian David Kinstlinger

Alliance Global Partners, Research Division

Great. And then Mobcrush has -- you said about $6 million revenue,

Super League is about $2 million in 2020, roughly. I didn't do the

math, but I assume your KPIs are higher, but maybe I'm wrong

because I didn't look too closely. If they are, what are they doing

different in terms of execution that SL -- that Super League can

learn and maybe hasn't been doing?

Ann Hand

CEO, President & Chair of the Board

Yes. No, good question again. So I mean, our KPIs -- it's why we

took the time to really kind of separate them out because they're

not completely apples-to-apples. So when we talk about the fact

that we're able to now reach 85 million Americans in the U.S., a

lot of that is on the back of the streamer's social reach, right?

That's still reach. It still counts. It's still what advertisers

want. It's highly relevant.

But it is using our business partners in the middle, those great

streamers to reach that audience. So it's leveraging their kind of

social reach and scale. When we talk about the Minecraft businesses

that we have. Mineville is able to reach 22 million users per year

through the Minecraft server system. Minehut is its own owned and

operated property.

So when I talk about the 3.4 million registered users that we have

and many of them are on Minehut, we own that customer 100% fully.

And so that owned and operated property, I think Mobcrush would

say, is very exciting to them because if they can package the kind

of reach they're getting through their streamers' reach and then

couple it with owned and operated, they believe that they can get a

much greater share of advertiser wallet. We feel the

same.

We offer brands and advertisers really deep engagement. And hey,

we've had good growth. And through that good growth, we certainly

are now giving them kind of enough critical mass to be interested

as -- very similar to the Netflix deal I talked about in the last

call. But now imagine, we can package with it, all of that

additional reach, those eyeballs off of that streaming

audience.

So I think those are the differences between the company. I think

what they've done well is by leveraging that reach of their

streamer base they're just able to go in and to grab a much bigger

share of advertiser wallet. We've been on our journey of doing it.

We certainly have proof points over the last 6 months of doing it.

Now you put that together, it really is a 1 plus 1 equals 3, 4, 5

for both sides of the house. So that's what we're excited

about.

I mean, Mike, the CEO and I have known each other for years. And

we've always sat down and had talks about our businesses. And look,

it's -- you're trying to jump in and create business models around

a really emerging category, but he has tremendous vision and

experience and the monetization of online kind of streaming

gamer-related content. It's a great complement to us.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

And the biggest thing for us both is when we talk now and as we've

seen our business models converge more and more, there was a magic

moment when we started these discussions where we realized not only

were our business models beautifully aligned, but as I alluded to,

media is all about scale.

You put our reaches together, our deep engagement together, our

player bases together, and it really does amplify everything that

we do.

Brian David Kinstlinger

Alliance Global Partners, Research Division

Great. One last one, and then I'll get back in the queue because I

have others. It's no secret the ad market is seasonal and the first

quarter is almost over. And typically in the ad market weaker than

the fourth quarter, are you too small for seasonality to impact

you? Or is that not the case?

Ann Hand

CEO, President & Chair of the Board

Yes. It's a little different in the gaming industry. You're

absolutely right that 4Q is always typically, in the advertiser

world, strong. The gaming industry benefits a bit because there's a

lot of new game launches in 1Q. But I do think that right now, we

don't see extreme seasonality.

I think what you've seen more of in our progress last year is that

we are continually improving quarter-on-quarter. Now that doesn't

mean it's always going to be perfectly that way in a stair step.

But what Mike would say, if he were on the call is that sometimes

he sees a little bit of a dip in 2Q because he's been riding a bit

of that -- the game publisher, new game release wave in

1Q.

But I think that between the 2 of us, we'll be able to smooth that

out.

Operator

And for your next question comes from the line of Allen Klee with

Maxim Group.

Allen Robert Klee

Maxim Group LLC, Research Division

Could you tell us what you think -- what your plans are for

potentially rolling out subscriptions in 2021?

Ann Hand

CEO, President & Chair of the Board

Yes. So we do have already a subscription model inside Minehut.

When people are participating in our marketplace, they can choose a

monthly purchase to upgrade their server capability. So it's small.

But we do have the mechanism for subscription as well as those

onetime digital good purchases.

For the most part inside Mineville for their direct-to-consumer

model, it is those onetime purchases of player entry fees or

cosmetic purchases. But what I am excited about is if you think

about subscription in a bigger sense, right now, Mobcrush is a free

tool kit. When you start to look at some of the broadcast

technology that we have inside Virtualis Studios, we believe there

could be a really interesting play there to put some of that

technology into their suite of tools and offerings and perhaps

create an upgrade, more of a freemium model, where those kind of

highest ranking streamers are looking for an advanced set of

content production and broadcast tools.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

So we believe that it's a worthy exploration to see what is the

role inside Mobcrush for subscription because we know the market

likes recurring revenue. And then continue to expand subscription

inside our own Super League properties as well.

So -- and then there's always licensing technology too, Allen. So

right now, we have, as I mentioned, big name media companies who

are trying out our Virtualis Studios product for their own

production needs. And it's not about gaming and e-sports. So we

believe that there could be as well technology licensing

opportunities.

Very similarly, there could be technology licensing opportunities

on the Mobcrush side of things with their great streamer, mid-tier

streamer tool kit. And if those things occur, those could take the

shape as some kind of monthly subscription-type model, more of like

a B2B or white label model.

Allen Robert Klee

Maxim Group LLC, Research Division

Okay. How do you think about, as people get vaccinated, the

opportunity for you to start doing brick-and-mortar type of events

that you had prior to the pandemic? And what that could potentially

represent?

Ann Hand

CEO, President & Chair of the Board

Yes. I mean, look, I spent a lot of my career in retail. My dad was

a franchisee and owned a lot of restaurants, and I grew up working

in them. And we're rooting for that brick-and-mortar operator, and

we still enjoy our great partnerships with Topgolf and Cinemark

theaters and others. So when they're ready to come back, I believe

they're going to need us more than ever as a new way to bring foot

traffic back in and try to reach a younger audience and use their

spaces and try to optimize that capacity in as many ways as

possible.

I have said though, on previous calls, I think we'll do it a little

differently now. We've advanced the tech enough that we really

don't need to be as hands-on with it. So if that retail partner is

interested in pop-up, e-sports experiences or other types of

entertainment, I think that's another retail licensing

subscription-type model where we can offer them to pay some kind of

tollgate or monthly fee to use our technology to drive more people

into their venues.

I like that. That was always the original vision of the retail

model was that at some point, we just really let the

brick-and-mortar owner do the heavy lifting as far as marketing the

event. They know their customer better than anyone, getting people

there, making sure it's a great experience. Not Super League doing

it from afar.

And so I think the -- with the vaccinations getting underway, when

we come back to retail, we'll have a much cleaner model with a

stronger margin profile.

Allen Robert Klee

Maxim Group LLC, Research Division

Okay. My last question is somewhat philosophical, but you currently

monetize a small fraction of the digital viewers that you have. And

I know that you get a high premium for that. But how do you think

about the opportunity of expanding it with programmatic and

technology where even if you don't get the high CPM, getting

something -- for something that you're getting nothing for could

actually be quite meaningful potentially on such a large user base

that you've created. So any thoughts on that?

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Ann Hand

CEO, President & Chair of the Board

Yes. I mean, this is -- you're right, it's philosophical. I mean,

we still protect it, no different than a lot of digital platforms

out there in the early days. It was all about let's -- a free

model, let's get as many people onto the platform as possible.

Really focused that -- #1 priority is a great experience, right? We

didn't want to too quickly try to monetize it because we didn't

want to turn them off from the experience.

And we know like gamers value that experience. They value their

community. And so with that, we've really tried to be careful about

where we introduce that inventory and make sure that it is

improving the overall experience. And I think the Netflix deal that

I spoke about in the last call is a perfect example of

that.

I mean kids were having a ball in the unique gameplay experience

that we created. They were watching cool trailers. They weren't

just seeing Netflix logos everywhere. Now that said, your question

about programmatic, I think it really goes back to, I just don't

want us to become a company that overly leans into

display.

Display, it's annoying for all of us, right? And so I think the key

is, is that video is engaging and fun. And I think the key for us

will be to find more and more video inventory that we can put into

our combined systems. Now the good news is, is that Mobcrush has

that. When a streamer is streaming, they can opt in to participate

in the advertising economy by saying, yes, I'm happy to promote Red

Bull.

And that is an ad unit that Red Bull is paying for, and it is a

premium ad unit. And so it's more about that type of programmatic

that we really want to focus on going forward. And remember, it's

got that ad block technology to it as well. And so we can guarantee

to that brand or advertiser that they're getting what they're

paying for.

But I do want to just be careful about programmatic and turn it on

smartly, and I really want it to be focused on video units where

you can see $10 and up CPMs. And look, I have no doubt between the

capability at Mobcrush and Mike's talents and what we've worked so

hard to build organically, I think we're going to be able to really

look at how do we preserve premium CPMs, but to your point,

sell-out a heck of a lot more of those units.

Operator

And your next question will come from Bill Morrison with National

Securities.

William Morrison

Yes. Can you hear me?

Ann Hand

CEO, President & Chair of the Board

I can hear you, Bill.

William Morrison

Great quarter, lots of interesting stuff going on. Just on the

merger itself. So can you remind me the surviving entity, is

Mobcrush in -- roughly you're going to issue like 12.5 million

shares. Is that it?

Ann Hand

CEO, President & Chair of the Board

Clayton, you want to take that?

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Clayton J. Haynes

Chief Financial Officer

Yes, that's correct. That is correct.

William Morrison

Okay. Good. On the sales team side, can you give me the relative

like size of both sales teams and like the relative efficiency of

both? And also then whose tools are more advanced for advertising?

And is there any like plans for having like a programmatic direct

platform, not using a sell-side platform? Those are my main

questions.

Ann Hand

CEO, President & Chair of the Board

Yes. Definitely on the Mobcrush side, on your last point, there

have been some tech that's been built to kind of create a little

bit more of -- again, I don't want to use the term programmatic,

but something that is a little bit more rinse and repeat or ways

that others can kind of take that inventory and sell it for us

without us having to continue to build up the direct sales

team.

And so there are some explorations going on that. I would say,

again, for the most part, most of the advertising sales to date for

both firms are coming from that direct side, though. As far as the

teams go, we find them very synergistic. Certainly, Mobcrush has a

very seasoned team -- direct sales team. We just started building

up our direct sales team about a year ago.

Ours has really been focused a lot on youth and brands and

advertisers trying to find youth gaming. And so in some ways, we've

really kind of started to dominate in that vertical. So you think

about the repeat business we continue to do with Moose Toys, even

the Disney+ and the Netflix deals, we're targeting young gamers. It

was family friendly, new releases.

So what's kind of nice is we've kind of been building out that

lane. And for a while...

[Technical Difficulty]

Clayton J. Haynes

Chief Financial Officer

Ann, are you there? Okay. So it sounds like she may have dropped. I

just sent her a quick note to that effect. She should be dialing

back in shortly.

Did you have any other questions there, Bill, or...

William Morrison

No. Clayton, maybe you can help me. So what's the relative size of

the teams? And then you were talking about getting to it like an

efficiency level, like 50% was like short term goal. How is that on

both sides?

Clayton J. Haynes

Chief Financial Officer

It's my understanding in terms of the size of the teams, I believe

on the Mobcrush side, I believe it's in the 9 to 10 range. And then

on the Super League side, that's in the 5 to 6 range. And then in

terms of the sales efficiency, I know Ann has spoken about that in

the past in terms of levels that we might want to get

to.

I've not had a chance to dive into the sales efficiency sort of on

the Mobcrush side just yet. And as you know, we continue to work

towards trying to build up our sales force efficiency over

time.

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Ann Hand

CEO, President & Chair of the Board

I'm back. Sorry, guys.

William Morrison

Okay. So I was just curious, on the sales efficiency on the Super

League side, how close are you to the 50% level? And that's kind of

where we left that.

Ann Hand

CEO, President & Chair of the Board

Yes. And I think that the best estimate I have for you on that

right now, Bill, is that we're kind of in that kind of 25% to --

kind of 20% to 25% range. What we're finding is that when brands

are wanting to do business with us, I guess it's a good thing

because a lot of these deals are coming in the kind of 6-figure

range, but it means they're doing full takedowns, right. And then

we'll have kind of quiet periods where we don't have that full

takedown happening.

As we've talked about, kind of like 80% is like a really super high

efficiency, high performing team, and we're still kind of trying to

march up that curve. I think what's going to be exciting is when we

sit down and really work with the Mobcrush sales team, and again, a

lot of this under Mike's leadership, to really look at their

efficiency metrics because I don't want to quote those right now

and misquote them, but look at what we can learn from each other,

how we can align across verticals, how we can combine, most

importantly, our ad inventory.

And so when they're going out and selling something to a Red Bull

or an Anheuser-Busch, they should be packaging all of our

age-appropriate ad content with it just like we should be packaging

their younger ad inventory against some of our younger

verticals.

So I just look forward to the next call where I can start to share

with you what we see as the combined entity and how we're

performing against it, but it's just a little too soon for me to

report on it.

William Morrison

Okay. Great. Congrats on the transaction.

Ann Hand

CEO, President & Chair of the Board

Thank you. Thank you. We're super excited. We looked at a lot of

companies -- and over the last year. And boy, a lot of them, I

think we would have gotten on a call and you guys would have said

this feels like a pivot. And it is a wonderful moment when you see

that both of us refining, refining our business model, as we've

known each other, our offices are just a few blocks away from each

other in Santa Monica before we both gave them up.

And to see us finally converge to a point where there's so much

alignment, it just felt to both companies like it was a match made

in heaven.

Clayton J. Haynes

Chief Financial Officer

Ann, if you could just double check my recollection on the size of

Mobcrush's sales team?

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Ann Hand

CEO, President & Chair of the Board

Mobcrush's sales team is more in the 10 person. So they're about 2x

ours. And I would say they've just -- they've been at it longer, a

very seasoned group of people. And it just, again, super

complementary.

Operator

[Operator Instructions] And for our last question, we have Brian

Kinstlinger with Alliance Global Partners.

Brian David Kinstlinger

Alliance Global Partners, Research Division

Great. I have 2 more. It's kind of a follow-up to that, talking

about fill rates of ads. I know in the past, about 3 quarters ago,

maybe even 2, you talked about all the inventory and the potential

it represents for ad revenue. What are the biggest impediments to

fill rates? And when do you see that inflection point? I mean, to

Allen's point, you've got your top 50 in terms of view you're

talking about. So when is that inflection point of when you can

start to get -- see stronger fill rates?

Ann Hand

CEO, President & Chair of the Board

Yes. I mean that's what we achieve when we combine, right? So

announcing today is the first step out of the gate. When we start

to go forward and tell advertisers, the added heft we can bring by

playing it together, it's just almost self-fulfilling that we're

going to grab a bigger share of wallet, more repeat business

because we become a go-to for them, one of the go-to places, one of

the rare kind of gaming-centric advertising solutions for

them.

So I do think that once we start seeing us putting our packages

together, we're going to see all those health metrics go the right

way, better fill through rates, preserving that good CPM, certainly

continuing repeats and bigger and bigger average deals. So that's

what we're so excited.

We're chomping at the bit to start doing. And so I think it's

inevitable. We've already bringing them under confidentiality,

brought that sales team together and the enthusiasm -- these are

hunters by nature. And so the enthusiasm in the call when they were

realizing, sharing pipeline and talking about the opportunities if

we became a combined company were material.

So I think that you'll start to see by the time we're reporting

next, already proof points of us selling more faster and bigger

deals. But the good news is we were already starting to improve on

those sales effectiveness metrics on our own, right? As I talked

about, 50% of our deals this year, Super League alone, are repeat

deals.

We're already trending with a higher overall deal size. So -- but

as you and Bill said, now let's put our money where our mouth is

and start showing that we leave no impression behind, right? That

we can sell-out more and more of that.

And if we can smartly fill in programmatic, I'm all for it. I

absolutely want to be able to scale this model. And I think there's

a smart way to do programmatic without suppressing our overall CPM

rate.

Brian David Kinstlinger

Alliance Global Partners, Research Division

Great. Lastly, to that -- to another point you just mentioned, in

3Q you had 2 customers that ran rather large campaigns. I believe

it was Netflix and Disney+, not that I'm sure. Were those customers

at least that ran large campaigns in 3Q, the same customers that

were your 2 that represented 36% of revenue in the fourth

quarter?

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Ann Hand

CEO, President & Chair of the Board

So certainly, we continue to have more deals in the pipeline with

both of those customers. The nice thing is for us is, is that the

larger customers that we had in 4Q like Snapchat and other kind of

big name media companies, I think, show that we're starting to have

the -- we don't just have -- it wasn't a onetime fluke solution for

Netflix, right. That them and their competition are coming back to

us as a go-to for their next kind of appropriate releases that are

targeting that type of audience.

So no, it was not just the same kind of basket of customers. It was

new customers, but it was all with that same kind of heft of the

ones that we talked about in 3Q. And like I said, the little bit of

tidbit I can share about 4Q is 50% repeat. And so that is

inevitably from that pool of people that we've talked about for

last year.

Operator

I'm not showing any further questions. At this time, this concludes

our question-and-answer session. I would now like to turn the call

back over to Ms. Hand for closing remarks.

Ann Hand

CEO, President & Chair of the Board

Okay. Well, other than me losing connection for a bit, I want to

thank you for joining the call today. Again, it's a fantastic day

for Super League. And a really bright future going forward, just

the company couldn't be more ecstatic. And we're just so excited to

join forces with the Mobcrush folks and their great

brand.

We look forward to speaking to you at our upcoming conferences and

when we report our first quarter results in May. Stay

safe.

Operator

Ladies and gentlemen, this concludes today's teleconference. Thank

you for participating. You may now disconnect your

line

SUPER LEAGUE GAMING, INC. FQ4 2020 EARNINGS CALL | MAR 11,

2021

Copyright © 2021 by S&P Global Market Intelligence, a

division of S&P Global Inc. All rights reserved.

These materials have been prepared solely for information purposes

based upon information generally available to the public and from

sources believed to be reliable. No content (including index data,

ratings, credit-related analyses and data, research, model,

software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced

or distributed in any form by any means, or stored in a database or

retrieval system, without the prior written permission of S&P

Global Market Intelligence or its affiliates (collectively, S&P

Global). The Content shall not be used for any unlawful or

unauthorized purposes. S&P Global and any third-party

providers, (collectively S&P Global Parties) do not guarantee

the accuracy, completeness, timeliness or availability of the

Content. S&P Global Parties are not responsible for any errors

or omissions, regardless of the cause, for the results obtained

from the use of the Content. THE CONTENT IS PROVIDED ON "AS IS"

BASIS. S&P GLOBAL PARTIES DISCLAIM ANY AND ALL EXPRESS OR

IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES

OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE,

FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S

FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE

WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall

S&P Global Parties be liable to any party for any direct,

indirect, incidental, exemplary, compensatory, punitive, special or

consequential damages, costs, expenses, legal fees, or losses

(including, without limitation, lost income or lost profits and

opportunity costs or losses caused by negligence) in connection

with any use of the Content even if advised of the possibility of

such damages. S&P Global Market Intelligence's opinions, quotes

and credit-related and other analyses are statements of opinion as

of the date they are expressed and not statements of fact or

recommendations to purchase, hold, or sell any securities or to

make any investment decisions, and do not address the suitability

of any security. S&P Global Market Intelligence may provide

index data. Direct investment in an index is not possible. Exposure

to an asset class represented by an index is available through

investable instruments based on that index. S&P Global Market

Intelligence assumes no obligation to update the Content following

publication in any form or format. The Content should not be relied

on and is not a substitute for the skill, judgment and experience

of the user, its management, employees, advisors and/or clients

when making investment and other business decisions. S&P Global

Market Intelligence does not act as a fiduciary or an investment

advisor except where registered as such. S&P Global keeps

certain activities of its divisions separate from each other in

order to preserve the independence and objectivity of their

respective activities. As a result, certain divisions of S&P

Global may have information that is not available to other S&P

Global divisions. S&P Global has established policies and

procedures to maintain the confidentiality of certain nonpublic

information received in connection with each analytical

process.

S&P Global may receive compensation for its ratings and certain

analyses, normally from issuers or underwriters of securities or

from obligors. S&P Global reserves the right to disseminate its

opinions and analyses. S&P Global's public ratings and analyses

are made available on its Web sites, www.standardandpoors.com (free

of charge), and www.ratingsdirect.com and

www.globalcreditportal.com (subscription), and may be distributed

through other means, including via S&P Global publications and

third-party redistributors. Additional information about our

ratings fees is available at

www.standardandpoors.com/usratingsfees.

© 2021 S&P Global Market Intelligence.

(2.50

%)

(2.50

%) (1.44

%)

(1.44

%)